In March 2019, Singapore has announced the most expensive city in the world to live in (alongside Paris and Hong Kong). Yet the property is still an asset people will invest in because of the potential it possesses.

If you’re investing in your 2nd (or subsequent) property, here are 7 things to know about Additional Buyer Stamp Duty (ABSD): who is liable to pay it, the exemptions, how to beat the tax, and so on.

Also read: 2 Key things to look out for when you get your 2nd home loan

1. What is the Additional Buyer Stamp Duty?

The Additional Buyer Stamp Duty (ABSD) applies to owners who purchase their second and subsequent property. It’s an extra tax the government imposes on residential properties (e.g., condominiums, private estates, HDB flats, shophouses with live-in residences, etc.)

2. The Purpose of ABSD

ABSD acts as a cooling measure to curtail the booming property market. Given that real estate prices skyrocketed by 9.1% in 2018, the Singapore government needed to put in place something that would prevent housing prices from going up further.

If the increased demand had been left unchecked, the upward trend would have led to a housing bubble. In such a bubble, many are likely to commit to loans they cannot afford, which increases the risk of foreclosures. When the bubble bursts, it would’ve led to more foreclosures, an oversupply of houses, and low demand

3. Who has to pay the ABSD?

You have to pay ABSD if you are a…

- Singaporean citizen purchasing a 2nd or subsequent residential property

- Permanent Resident (PR) purchasing your 1st and subsequent residential property

- Foreigner purchasing your 1st and subsequent residential property (Except for citizens from the USA, Iceland, Liechtenstein, Norway or Switzerland)

That’s right: for PRs and foreigners, even if this is your first property purchased in Singapore, you are liable to pay for ABSD.

As long as you own a shared interest in a property (even if that’s an investment property with your siblings), you are liable to pay for ABSD. Any other property purchased will be considered as your 2nd property. If paying the ABSD is an issue, you may want to rethink keeping your stake in the shared property.

4. Updates in ABSD Regulation

With the new regulations in play, homeowners can expect a 12% or higher ABSD rate on the current valuation of the property or the selling price, whichever is higher.

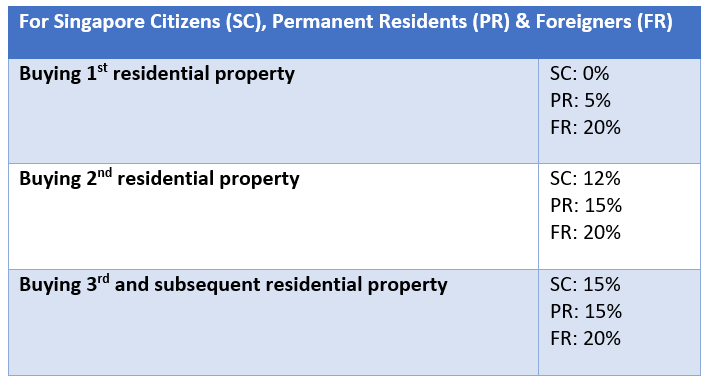

The current ABSD rates are as follows:

Case Study 1:

Sam is a Singaporean citizen looking to purchase his 2nd residential property for investment purposes. The property is valued at $500,000. He agrees to buy it at $550,000.

Case Study 2:

Martha is a Malaysian PR looking to purchase her 2nd condominium to rent out. The property is valued at $1,200,000. After negotiations, she purchases it at $1,050,000.

5. How can I pay for ABSD?

ABSD can be paid via NETS, cheque, or cash order through the e-Stamping Portal. Other avenues include IRAS e-terminals or specific branches of SingPost Bureaus (Shenton Way, Novena, Chinatown, and Raffles Place).

While CPF (Ordinary Account) funds can be used to pay your ABSD, you have to pay out of your pocket first before getting reimbursed from your CPF account.

6. When must I pay the ABSD?

The deadline to pay is within 14 days for contracts signed in Singapore, and 30 days for contracts signed overseas. You’ll want to pay punctually to prevent paying the hefty penalty (which can be 4 times your ABSD!).

7. Exemptions from ABSD in Singapore

You won’t have to pay the ABSD if:

- You sign the agreement to sell your current property before getting the Option to Purchase (OTP) on your new property

- You’re downgrading from private property to a resale flat. However, the private property must be sold within six months – though you can extend this to one year if you get approval from the relevant authorities.

- Your properties are located outside of Singapore (subject to the laws of the respective country)

Moving Forward:

ABSD can eat into your finances. One of the most common ways to avoid the tax is decoupling – essentially, transferring your share of the property to your spouse. Afterward, you’ll be free to purchase your 2nd property as though it’s your first.

Your spouse will have to pay the Buyer Stamp Duty and all the associated legal fees when they take over your share, but this is generally far cheaper than the ABSD.

(Read also: Can I Transfer My Share of the House to My Spouse/Child to Avoid ABSD?)

Buyer's Stamp Duty (BSD) 买方印花税

Based on the purchase price or market value, whichever is higher

|

Percentage

|

第一 First $180,000

|

1%

|

第二 Next $180,000

|

2%

|

之后 Next $640,000

|

3%

|

Remaining amount

|

4%

|

BSD = (3% x Property Price) - $5,400

BSD = (4% x Property Price) - $15,400

Additional Buyer's Stamp Duty (ABSD)

附加买方印花税

Profile Of Buyer

|

ABSD Rates

| ||

1st Property 第一房产

|

2nd Property 第二房产

|

3rd Property & Subsequent Purchase 第三后以上房产 | |

Singapore Citizens 新加坡公民

|

-

|

12%

|

15%

|

Singapore Permanent Residents 新加坡永久居民

|

5%

|

15%

|

15%

|

Foreigners 外国人买家

|

20%

|

20%

|

20%

|

Corporate Entities 企业、公司

|

25%

|

25%

|

25%

|

Seller's Stamp Duty (SSD) 卖方印花税

- Purchased on and after 11-Mar-2017 【 在2017年3月11日及之后购买】

Holding Period

|

SSD payable

|

Up to 1 Year 第一年

|

12% of consideration or value, whichever is higher 【估价或价值,以较高者为准】

|

Up to 2 Years

|

8% of consideration or value, whichever is higher

|

Up to 3 Years

|

4% of consideration or value, whichever is higher

|

More than 3 Years

|

No SSD Payable 【无需支付】

|

Seller's Stamp Duty (SSD) - Purchased between 14-Jan-2011 to 10-Mar-2017

Holding Period

|

SSD payable

|

Up to 1 Year

|

16% of consideration or value, whichever is higher

|

Up to 2 Years

|

12% of consideration or value, whichever is higher

|

Up to 3 Years

|

8% of consideration or value, whichever is higher

|

Up to 4 Years

|

4% of consideration or value, whichever is higher

|

More than 4 Years

|

No SSD Payable

|